Return on Investment Ratio Calculator - Glossary:

Return on Investment (ROI):

In other words, return on investment helps determine whether it was worth the company's time and efforts to raise those funds.

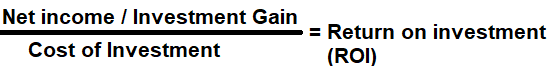

Formula:

How to use this equation?

It is calculated by dividing net income by the cost of investment. The values for net income can be obtained from income statement, total shareholder's equity and long-term liabilities from balance sheet. To use this ratio, divide net income by cost of investment.Note:

Cost of Investment: Add current year and previous year long-term liabilities and total shareholder's equity value, and then divide that value by 2 to get the average cost of investment.

Net Income:

Profit left over after deducting all its expenses (cost of goods, operational expenses, interest cost, depreciation cost, taxes and if any dividend paid).

Long-term Liabilities:

Non-current liabilities are financial obligations owed by a company that is not due within a year. Long-term liabilities mostly consist of notes payable, bonds payable, mortgages and leases, but can include other non-immediate expenses such as pension obligations.

Total Shareholder's Equity:

Total shareholder's equity is the value left in the company after subtracting total liabilities from total assets.

Example:

A company with net income of $100,000 and average cost of investment of $300,000 is 33%. Return on investment is $0.33 for each dollar of investment. In case, an investor buys $100,000 worth of market securities at the beginning of year one and sells it at end of year two for $120,000.00. The net gain from such investment would be $20,000 and return of investment is 20% or $0.20 for each dollar of investment.