Debt to Equity Ratio Calculator - Glossary:

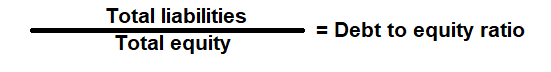

Debt to Equity Ratio: Shows the proportion of Total Liabilities to Total Equity. In simple words, it measures the riskiness of a company's financial structure.Formula:

How to use this equation?

This is a balance sheet component; the values are commonly stated against Total Liabilities and Total Equity. To use this ratio, divide the total liabilities by total equity.Total Liabilities (Debt):

Total Liabilities is the source of the funds such as short term and long-term external borrowing that is mainly used to fund its asset purchase.

Total Shareholder's Equity (Equity):

Total equity is the is the value left in the company after subtracting total liabilities from total assets.

Example:

Debt to equity (D/E) ratio for a company with a total liability of $360,000 and total equity of $720,000 is 0.5:1. It means that, the assets of the company are funded 2-to-1 by investors to creditors. In other words, the company has a $0.50 of debt for every dollar of equity.